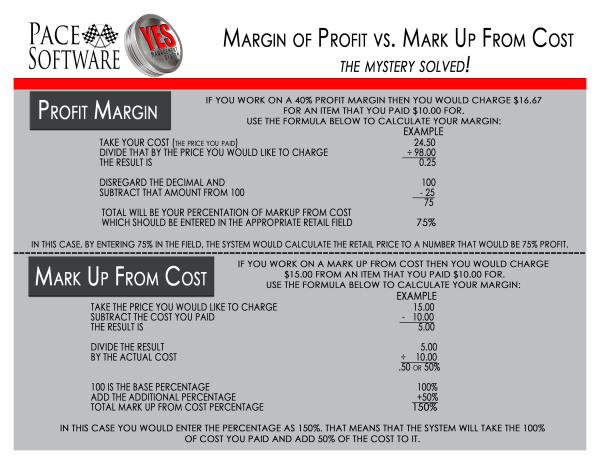

Margin of Profit vs. Mark up From Cost

The mystery solved!

A frequent request from our customers is for assistance with setting markups. This question usually leads to a deeper discussion about Profit Margin Pricing versus Markup from Cost. If you’ve ever found yourself asking some of these same questions, read on...

PROFIT MARGIN

If you work on a 40 percent profit margin then you would charge $16.67 for an item that you paid $10.00 for. Use the formula below to calculate your margin:

| EXAMPLE | |

| • TAKE YOUR COST (the price you paid) | 24.50 |

| • DIVIDE THAT BY THE PRICE YOU WOULD | / |

| LIKE TO CHARGE AT THIS RETAIL LEVEL | 98.00 |

| • THE RESULT IS | 0.25 |

| • DISREGARD THE DECIMAL AND | 100 |

| SUBTRACT THAT AMOUNT FROM 100 | -25 |

| 75 | |

| • TOTAL WILL BE YOUR PERCENTATION OF MARKUP FROM | 75% |

| COST WHICH SHOULD BE ENTERED IN THE APPROPRIATE | FIELD |

In this case, by entering 75% in the field, the system would calculate the retail price to a number that would be 75% profit.

MARK UP FROM COST

If you work on a mark up from cost then you would charge $15.00 from and item that you paid $10.00 for.

| EXAMPLE | |

| • TAKE THE PRICE YOU WOULD LIKE TO CHARGE | 15.00 |

| • SUBTRACT THE COST YOU PAID | -10.00 |

| • THE RESULT IS | 5.00 |

| • DIVIDE THE RESULT | 5.00 |

| • BY THE ACTUAL COST | /10.00 |

| .50 OR 50% | |

| • 100 IS THE BASE PERCENTAGE | 100% |

| • ADD THE ADDITIONAL PERCENTAGE | 50% |

| • TOTAL MARKUP FROM COST PERCENTAGE | 150% |

In this case you would enter the percentage as 150%. That means that the system will take the 100% of cost you paid and add 50% of the cost to it.

Click here to download a Profit Margin Pricing vs Markup from Cost Quick Reference Guide.